Bank Islam, a Malaysian Islamic Bank established in 1983, operates a Sharia banking system. It is one of the most prominent banks in Malaysia, offering several financial services. Among its products and services are personal banking, credit card, financing, digital banking and wealth management. Bank Islam offers personal loan as a product under its financing services, providing financial aid to its clients. Additionally, the bank has continually contributed to the growth and development of the Malaysian society through its support for SMEs, community development as well as educational impact.

Bank Islam Personal Loan

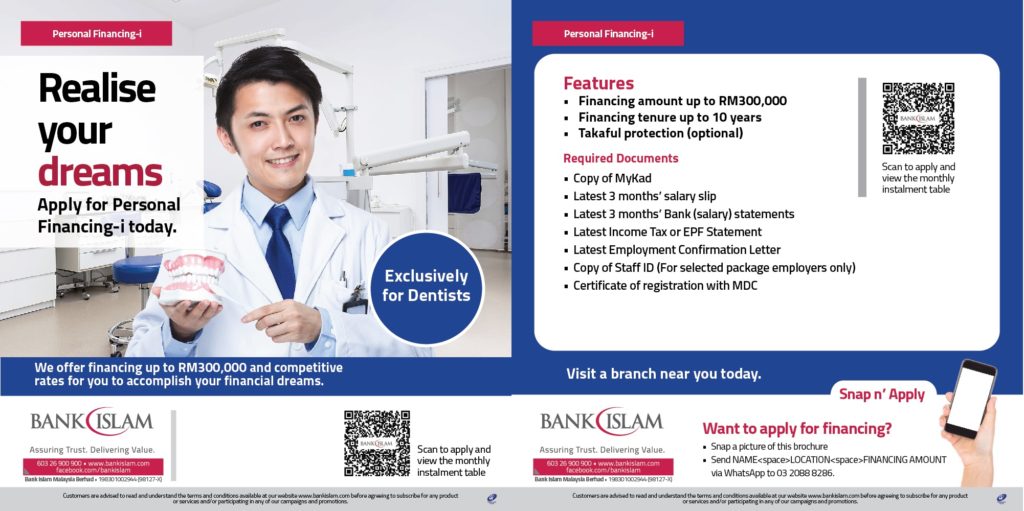

1. Personal Financing for Professional Program

Benefits And Features:

- Financing Quantum: Based on eligibility limit and subject to minimum amount of RM10,000 and maximum amount of RM400,000

- Payment Period: Maximum of 10 years (120 months) or up to the retirement age, whichever is earlier

Financing Rate Offer With Takaful Coverage:

Floating Rate

- 1-3 years : SBR + 2.97% p.a (Calculate profit on a daily basis based on “Monthly Rest”)

- 4-10 years : SBR + 3.18% p.a (Calculate profit on a daily basis based on “Monthly Rest”)

Financing Rate Offer Without Takaful Coverage:

Floating Rate

- 1-3 years : SBR + 4.45% p.a (Calculate profit on a daily basis based on “Monthly Rest”)

- 4-10 years : SBR + 6.35% p.a (Calculate profit on a daily basis based on “Monthly Rest”)

Eligibility and Requirements:

- Applicant must be above 25 years old and not exceeding the retirement age at the end of payment period

- Malaysian citizen

- Working as a professional Medical Doctor, Dentist, Accountant, Engineer, Lecturer, Architect, Safety Officer, Pharmacist, Veterinary, Optometrist or Optician, Quantity Surveyor and Actuary

- Minimum basic salary of RM4,000 for Non-Package

- Minimum basic salary of RM5,000 for Engineer & Accountants

- Minimum basic salary of RM15,000 for financing above RM300,000 under Professional Program

Documents Required:

- IC

- Latest 3 months salary slip

- Latest 3 months Bank ( salary) statement

- Employer Confirmation Letter (ECL)

- EPF Account Statement

2. Personal Financing-i Non Package

Benefits And Features:

- Financing Quantum: Based on eligibility limit and subject to minimum amount of RM10,000 and maximum amount of RM300,000

- Payment Period: Maximum of 10 years (120 months) or up to the retirement age, whichever is earlier

Financing Rate Offer With Takaful Coverage:

Flat Rate

- 1 – 3 years : 4.5% p.a. (Flat). (Calculate profit on a daily basis based on “Sum of Digit”)

- 4 – 8 years : 5.99% p.a (Flat). (Calculate profit on a daily basis based on “Sum of Digit”)

- 9 – 10 years : 6.99% p.a. (Flat). (Calculate profit on a daily basis based on “Sum of Digit”)

Financing Rate Offer Without Takaful Coverage:

Flat Rate

- 1 – 3 years : 6.0% p.a. (Flat). (Calculate profit on a daily basis based on “Sum of Digit”)

- 4 – 8 years : 7.5% p.a (Flat). (Calculate profit on a daily basis based on “Sum of Digit”)

- 9 – 10 years : 7.5% p.a. (Flat). (Calculate profit on a daily basis based on “Sum of Digit”)

Eligibility and Requirements:

- Applicant must be 18 years and not exceeding the retirement age at the end of payment period

- Malaysian citizen

- Earning a minimum fixed income of RM4,000 per month

- Applicant must be a continued employee in any of the following:

- Public Listed Companies

Documents Required:

- A copy of identity card

- Latest 3 months’ salary slip

- Latest employer’s confirmation letter

- Latest income tax form (Form B or Form EA/EC) or latest 3 months Bank Statements of salary crediting account, or any other latest supporting document such as EPF statement (or all these 3 documents, if required)

3. Personal Financing-i Package

Benefits And Features:

- Financing Quantum: Based on eligibility limit and subject to minimum amount of RM10,000 and maximum amount of RM300,000

- Payment Period: Maximum of 10 years (120 months) or up to the retirement age, whichever is earlier

Financing Rate Offer With Takaful Coverage:

Floating Rate (Base Rate)

- 1-3 years : SBR + 2.18% p.a (Profit is calculated on a daily basis based on “Monthly Rest”)

- 4-10 years : SBR + 2.25% p.a (Profit is calculated on a daily basis based on “Monthly Rest”)

Financing Rate Offer Without Takaful Coverage:

Floating Rate (Base Rate)

- 1-3 years : SBR + 4.15% p.a (Profit is calculated on a daily basis based on “Monthly Rest”)

- 4-10 years : SBR + 6.05% p.a (Profit is calculated on a daily basis based on “Monthly Rest”)

Eligibility and Requirements:

- Applicant must be 18 years and not exceeding the retirement age at the end of payment period

- Malaysian citizen

- Earning a minimum fixed income of RM2,000 per month

- Earning a minimum fixed income of RM8,000 per month for financing above RM300,000

- Applicant must be a continued employee in any of the following:

- Government Sector

- Selected Public Listed Companies

- Subsidiaries of Government or Selected Public Listed Company

- Other Prominent Private Limited Companies as categorized under package companies listed by Bank Islam

Documents Required:

- A copy of identity card

- Latest 3 months’ salary slip

- Latest employer’s confirmation letter

- Latest 3 months Bank Statements of salary crediting account

- Latest income tax form (Form B or Form EA/EC) or any other latest supporting document such as EPF statement (or both if required)

Fees and charges, product disclosure sheet, terms and conditions as well as other downloadable information regarding Bank Islam personal loan are available on the bank’s website. Additional documents for respective professionals under the Personal Financing for Professional Program are also available on the website.

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments