How to get Migo Loan is quite simple. You can do this in two ways, which are USSD Code or via their website.

Migo, founded in 2013, is headquartered in San Francisco and currently operates in Nigeria and Brazil. Migo is an embedded lending platform that enables companies to extend credit to consumers and small businesses in their apps.

This loan platform is registered and licenced under the Central Bank of Nigeria (CBN), the National Information Technology Development Agency (NITDA) and the Nigerian Communications Commission (NCC).

How to Get Migo Loan via USSD Code

- On your phone, dial *561#

- Click on “loan” to Request a loan.

- Wait for the loan offer to appear on the screen and accept.

- Enter your account number and other required information

- Receive your loan amount in minutes

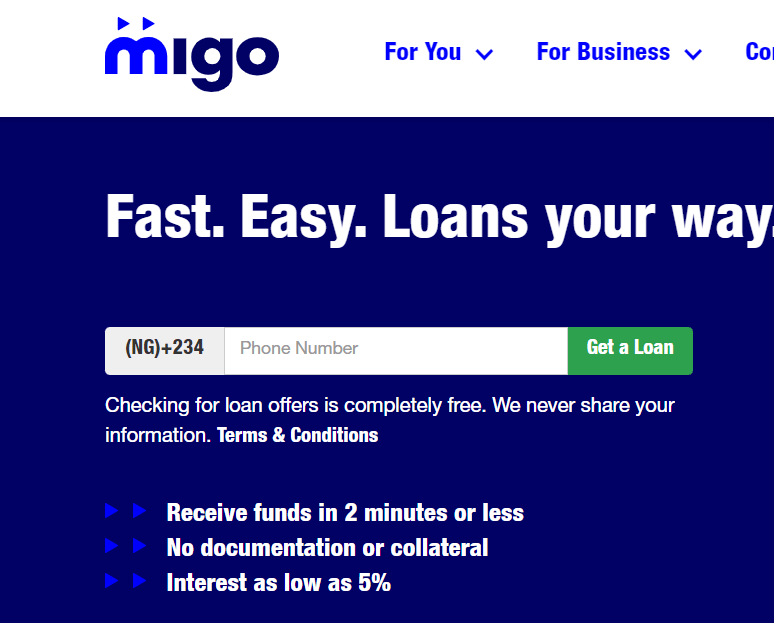

Via Website

- Log on to their website here

- Enter your phone number.

- Complete verification via the code sent to your phone number

- Choose “check loan offer”.

- Enter your account number and all other necessary information.

- Receive your loan within minutes.

- Requirements of your debit card details for Loan repayment.

Note that your Bank Verification Number (BVN), which is necessary for checking your loan eligibility and also for easy deductions from your bank account in repayment of your loan must be provided alongside your debit card details.

Migo provides a platform for users to buy products from online merchants on credit (that is, buy now and pay later) when they make payment through Migo; merchants such as Buypower.ng, Flutterwave, Nairabox and Wellahealth. The process goes as simply as stated below:

- customer makes purchase

- Migo pays the merchant at the point of purchase

- customer pays Migo over time.

Migo offers services in affiliation with banks, merchants, telecommunications outfits and fintechs.

Check out this post on Zenith Bank USSD Codes.

You may also like...

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments