How to get Pyypl Virtual Visa Card from UAE

By Esther Owolabi on October 14, 2024

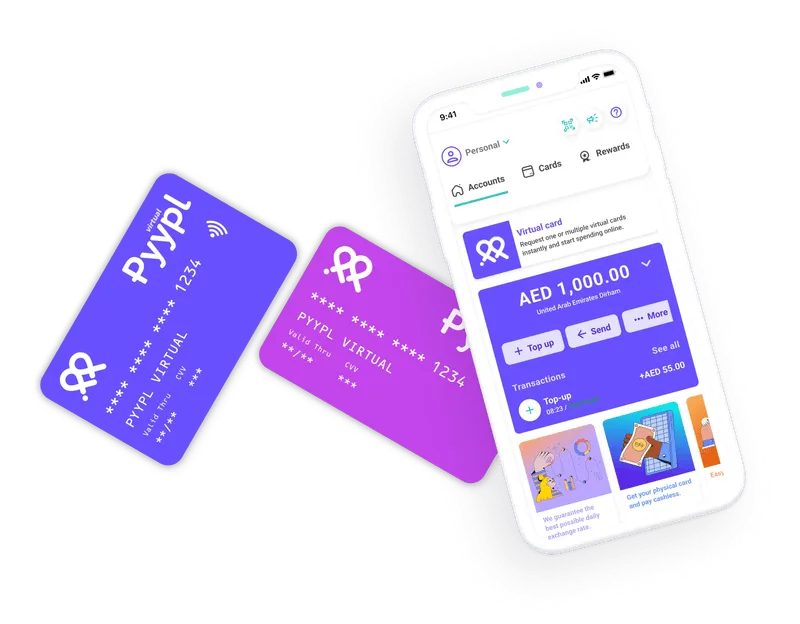

For those unfamiliar with Pyypl, it might sound similar to PayPal. However, Pyypl is a distinct payment application that originated in the UAE. You pronounce it the same way you would pronounce “people“. Pyypl is a digital platform that allows users to transfer money, make online payments, and manage various financial transactions without the need to visit a physical bank. The Pyypl virtual Visa card is your gateway to financial convenience! In this article, we take a look at how you can get Pyypl virtual Visa card from the UAE, also highlighting some features of the card and many more.

Here are some features/benefits of the Pyypl virtual card:

- No paperwork is necessary—just provide a few personal details, and you’re all set

- No salary required

- Sign up on your smartphone

- You can cancel the card at any time without any obligations or long-term commitments

- The Pyypl virtual Visa card is accepted at more than 100 million stores worldwide (wherever Visa is accepted)

- Effortlessly recharge your card using your preferred method, whether it’s via mobile transfer, debit card, or directly from your bank account

- Your account security is assured with the ability to freeze and unfreeze your account at any time, ensuring full control. Additionally, your card is protected against unauthorized third-party access, safeguarding your sensitive information

- Enjoy super fast payments and transactions with Pyypl

How to get Pyypl Virtual Visa Card from UAE

Obtaining a Pyypl virtual Visa card in the United Arab Emirates is quick and straightforward, just as it is in any other part of the world.

Follow the simple steps below to get your card:

- Download the Pyypl mobile app. You can do this by opening the PlayStore on your Android device or the App Store on your Apple device and searching for “Pyypl”. Or simply click here

- Sign up by providing the neccessary information, and your virtual card will be ready in minutes!

- Top up your card through any channel that’s most convenient for you, with any amount you choose

- You can now begin to spend and make transactions with your newly created virtual Visa card.

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments