Quickteller is a Nigerian-based financial technology company owned by Interswitch. It provides various services, including bill payments, fund transfers, airtime recharge, and other financial transactions through its platform. It enables users to make payments for utilities, goods, and services online using their bank accounts or cards. Quickteller offers convenience and efficiency by allowing users to perform these transactions from the comfort of their homes or offices, reducing the need to visit physical locations such as banks or utility offices. It has become an integral part of the country’s digital payment ecosystem, contributing to the growth of online financial transactions in Nigeria. Besides these services, Quickteller also offers small, short-term loans that are intended to cover immediate financial needs. Let us discuss how to get a Quickteller loan.

It is important to know however, that loan amounts granted are based on your credit/loan history. In most cases, you may not get a loan if you have an outstanding/unsettled debt with other financial institutions or loan apps. Also, you stand a better chance if you have a high transaction history with Quickteller

How to get a Quickteller Loan

There are three ways you can apply for a Quickteller loan. These are via website, app and USSD code.

Website:

- Visit https://www.quickteller.com/loan-request

- Enter the loan amount, the bank account number where you want to receive the funds, as well as your bank name.

- Once you’ve compared lenders, choose the one that best suits your needs and accept their loan offer.

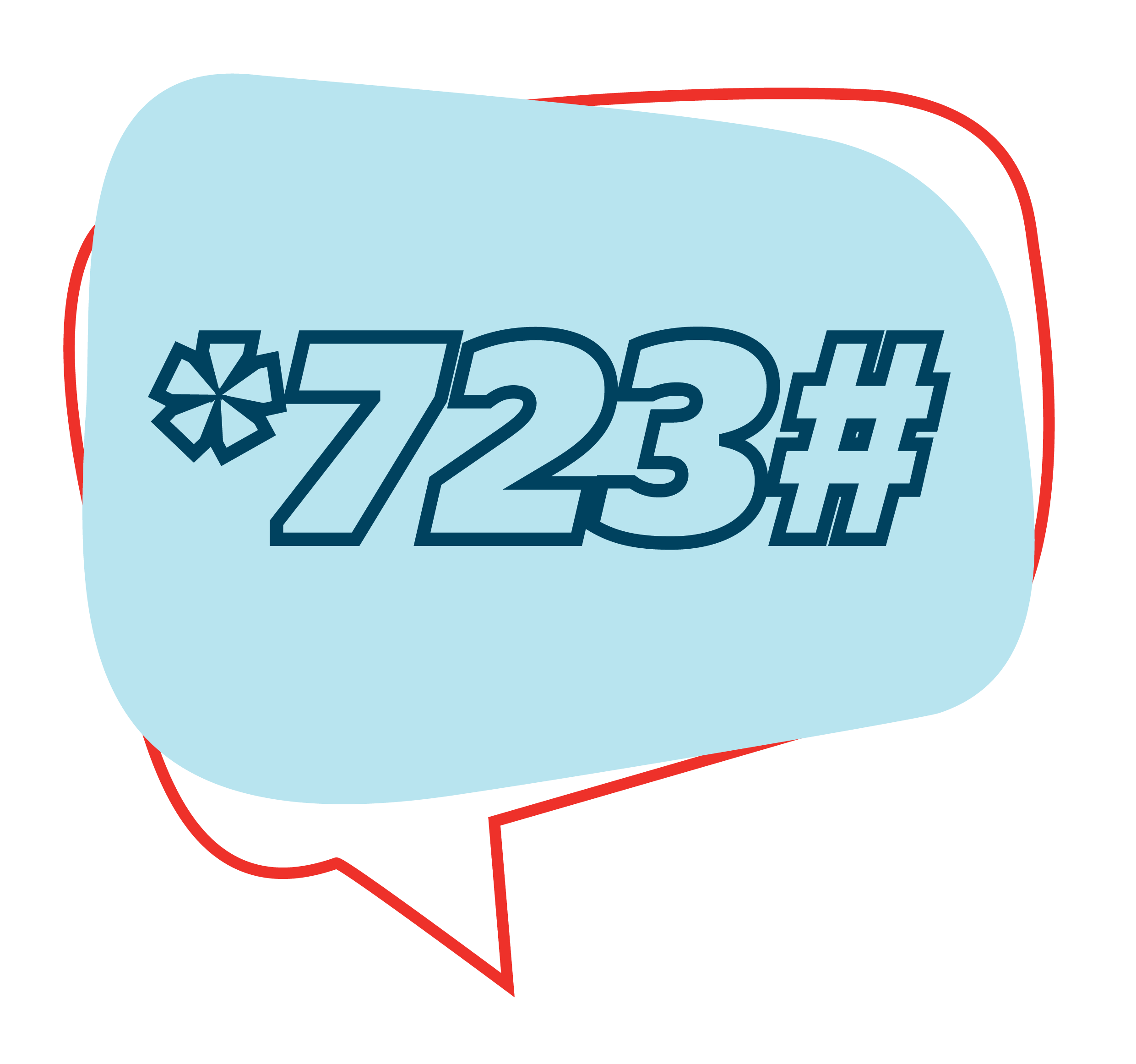

USSD Code:

- On your bank registered number, dial *723#

- Select ‘Get a Loan’

- Follow the prompts to get your loan disbursed

Mobile App:

- Download the Quickteller app from the Google Play Store or Apple App Store (you have a higher chance if you’re an existing customer with a good transaction record).

- On the homepage, select Loan

- Click on Request Loan

- Select a preferred option based on the available offers

- Accept the offer and have your loan disbursed

Note that you must provide personal and financial information to register/sign up for and request a loan.

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments