Low Income Loans Providers in Australia

By Esther Owolabi on November 4, 2024

Managing day-to-day expenses can be challenging, especially for low-income earners. From regular bills to unexpected costs, there are times when you might find yourself short on cash, making a loan a necessary option. However, it is essential to understand the type of loan providers you choose. If you are in Australia and facing financial pressures like these, this guide is for you. Here, we will look at low-income loans providers in Australia, covering key details on application processes, repayment options, fees, and charges to help you make an informed choice. These loans may come in various forms, such as payday loans, personal loans, or federal assistance, among others.

Low Income Loans Providers in Australia

1. Red Tree Finance

Red Tree Finance offers fast, hassle-free loans, thoughtfully tailored to each individual’s financial situation, backed by a commitment to responsible lending practices. Although the fees and interest rates are quite high, Red Tree offers up to $5,000 loan with an option to repay weekly, fortnightly or monthly.

Eligibility criteria for Red Tree Finance loans:

- Must be an Australian citizen, permanent resident or hold a valid visa

- Be at least 18 years old

- Own a vehicle registered and fully paid off in your name

- Have a minimum of three (3) months of employment

Fees/Charges:

- Loan amount: $2,100 – $5,000

- Application fee: $0

- Annual interest: 47%

- Standard establishment fee: $400

- Direct debit dishonour fee: $35.00 debit dishonour fee may be issued if a scheduled payment is missed or returned unpaid

- Other fees: $20 (included in loan)

How to Apply:

- Visit https://redtreefinance.com.au/apply/

- Fill out the online application form with the necessary and accurate information

- Your application will be submitted for review by an assessor

- Your application results will be ready within two business hours after submission

2. Fundo

Fundo offers a minimum of $500 and a maximum of $5,000 to low income earners. These loans come with flexible eligibility requirements and repayment options. Fundo loans come with no hidden fees. Once approved, borrowers receive the loan amount in their bank account within a minute.

Eligibility criteria for Fundo loans:

- Have at least $1,000 in income per fortnight. This can be from employment or government benefits like Centrelink.

- Must be able to repay your loan conveniently

Fees/Charges:

- For loan amounts between $500 and $2,000:

- 20% establishment fee

- 4% monthly fee

- For loan amounts ranging from $2,001 to $5,000:

- $400 establishment fee

- 47.80% interest per annum

How to Apply:

- Visit Fundo

- Click on Apply Now

- Click on Continue to confirm that you really need a loan

- Adjust the slider to select your desired loan amount, then choose a purpose for the loan

- Click on Continue.

- Proceed to supply your personal details, income expenses, bank verification and card verification. Make sure to provide a valid phone number, as you will receive a 6-digit code on it for verification

- Confirm your application and submit

- Once approved, the funds will be available in your bank account within a few minutes.

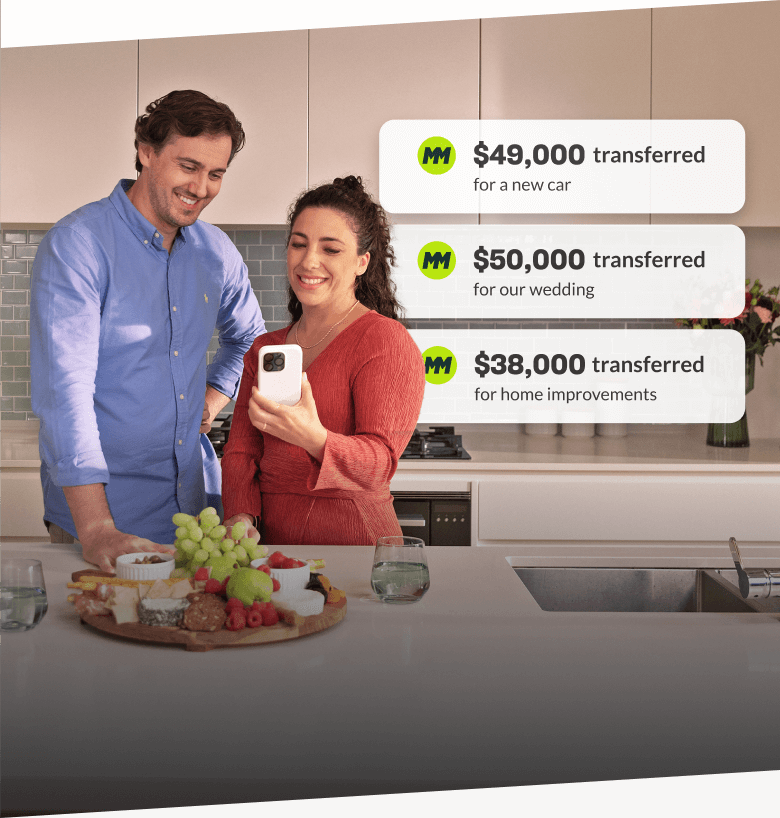

3. MoneyMe

This lender provides low-income personal loans and also offers same day payout. MoneyMe has over a hundred thousand active users who trust their services in Australia. MoneyMe offers loans ranging from $5,000 to $50,000 for borrowers who meet all requirements and have a good credit score. Repayment tenure for these loans is between three (3) to seven (7) years.

Eligibility criteria for MoneyMe loans:

- Be an Australian citizen, New Zealand citizen or a permanent resident

- Be at least be 18 years old

- Earn more than $30,000 per annum from employment

Fees/Charges:

- $395 establishment fee for loans up to $15,000

- $495 establishment fee for loans above $15,000

- $10 monthly fee

- Interest rate is between 6.74% per annum an 24.49% per annum

How to Apply:

- Visit MoneyMe

- You can get an estimated repayment amount for any amount you want to borrow and for your chosen repayment term. Simply fill out the form on the left side of your screen, and an estimate will instantly appear in the box next to it.

- Click on Get a quote

- Fill out the form and click on Next.

- Follow the remaining steps and wait for a confirmation/approval.

4. WA No Interest Loans Scheme (WA NILS)

WA NILS is a West Australia initiative that provides low income earners with zero interest loans. This scheme assists individuals and families with household necessities such as appliances and furniture, medical and dental care, education as well as vehicle related purchases. WA NILS does not offer cash, living expenses, debt consolidation, airfares and other related expenses. Loan amounts can go up to $2,000 for household expenses and up to $5,000 for a vehicle loan.

Eligibility criteria for WA NILS Loans:

- To check your eligibility for a loan, visit the WA NILS website, scroll all the way down to where it says Am I Eligible for a WA NILS Loan?

- Answer each question correctly to unlock the next one, which will appear after you’ve completed the previous question

- Once you successfully answer these questions, an approval prompt will appear confirming your eligibility. Click on it to proceed with your application

- Applicant must be at least 17 years old.

Fees/Charges:

WA NILS does not charge applicants for loans. However, WA NILS pays the retailer/service provider directly if your loan is approved.

How to Apply:

- By following the steps for eligibility above, you are automatically redirected to the application portal

- You are to read through the following page, ensuring that all necessary documents are available

- click on Apply Now

- Sign up as a new user and complete each step that follows.

5. HousingVic

HousingVic is one of the low income loans providers in Australia that offers interest free/low interest loans to eligible citizens. It is under the Department of Families, Fairness and Housing in Victoria, Australia. HousingVic’s aim is to provide housing services and support to Victorians. These may include purchase of essential household items like fridges, washing machines, televisions, beds etc. They also provide assistance with dental and medical care, as well as educational support.HousingVic offers loans ranging from $300 to $1,200, with repayment terms of 12 to 18 months.

Eligibility criteria for HousingVic Loans:

- For the No Interest Loan Scheme (NILS):

- You must have a health care or pension card or be on a low-income

- Must have lived at your current address for more than three months

- Show that you are capable of repaying your loan.

- For Low Interest Loans:

- Applicant must have a health care card or get Family Tax Benefit Part A

- Must have lived at your current address for more than three months

How to Apply:

HousingVic partners with several initiatives to bring this support to its citizens.

- Visit HousingVic’s website

- Under the Housing Toolbox section, click on the type of loan you would like to apply for

- You will be directed to different sections showcasing the available housing services. Choose the option that best fits your needs and continue with the application process.

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments