United Overseas Bank, UOB, was founded on 6 August 1935 by Wee Kheng Chiang. It is headquartered in Singapore with over sixty-eight (68) branches in Singapore and over five hundred (500) branches spread across South East Asia, Western Europe and North America. It is the third largest bank in Southeast Asia by total assest. Services renderered by UOB include retail banking, assets management, insurance, business banking, amongst others. In this article, we take a look at UOB credit cards available in Singapore, highlighting their features, eligibility and other details.

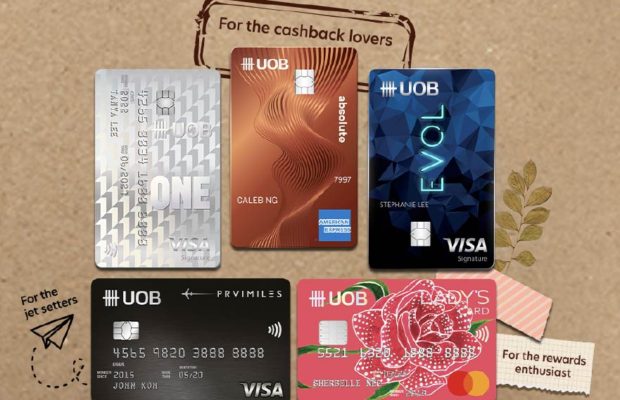

UOB Credit Cards Available in Singapore

A detailed list of UOB credit cards available in Singapore

1. UOB One Credit Card

Features & Benefits:

- Up to 10% cashback on daily spend at McDonald’s, DFI Retail Group, Grab, SimplyGo, Shopee and UOB Travel

- Up to 4.33% cashback on Singapore Power utilities bill

- Up to 3.33% cashback on all retail spend

- Fuel savings of up to 24% at Shell and SPC

- Greater savings with up to 6.0% p.a. interest with UOB One Account

Eligibility And Fees:

- Minimum Age: 21 years

- Singaporean/PR: Instant Card approval via Myinfo

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees: With effect from 1 January 2024:

- Principal card: S$196.20 (first year fee wavier)

- 1st Supplementary Card: Free

- 2nd Supplementary Card onwards: S$98.10

2. UOB Absolute Cashback Credit Card

Features & Benefits:

- 1.7% limitless cashback

- No minimum spend

- No spend exclusions

Eligibility And Fees:

- Minimum Age: 21 years

- Singaporean/PR

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Principal Card Fee:

- S$196.20 yearly

- First year card fee waiver

- Supplementary Card Fee:

- First card free

- S$98.10 for subsequent cards

3. UOB EVOL Credit Card

Features & Benefits:

- 10% cashback on Online and Mobile Contactless spend

- 10% cashback on Overseas In-store FX spend

- Greater savings with up to 6.0% p.a. interest with UOB One Account

- Southeast Asia’s first bio-sourced card with a suite of sustainable privileges

- No annual fees when you make 3 transactions monthly

Eligibility And Fees:

- Age: 21 years and above

- Singaporean/PR: Instant Card approval via Myinfo

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees:

- Enjoy no annual fee on your Principal Card when you make min. 3 transactions per month for 12 consecutive months prior to your card anniversary date

- With effect from 1 January 2024:

- Principal card: S$196.20 (first year fee wavier)

- 1st Supplementary Card: Free

- 2nd Supplementary Card onwards: S$98.10

4. Lazada-UOB Card

Features & Benefits:

- Get up to 15% rebates on Lazada spend

- 5% rebates on dining, entertainment and transport categories

- Plus, enjoy up to 6.0% interest p.a. on savings with UOB One Account

Eligibility and Fees:

- Minimum Age: 21 years

- Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees:

- With effect from 1 January 2024:

- Principal card: S$196.20 (first year fee wavier)

- 1st Supplementary Card: Free

- 2nd Supplementary Card onwards: S$98.10

5. UOB Lady’s Credit Card

Features & Benefits:

- 10X UNI$ per S$5 spent (4 miles per S$1) with no min. spend

- Up to additional 15X UNI$ per S$5 spent (6 miles per S$1) when you save with UOB Lady’s Savings Account

- UNI$1 per S$5 spent (0.4 miles per S$1) on other purchases

- 0% Lady’s LuxePay – 6 or 12-month installment plan with no interest or processing fees

- Free e-Commerce protection for online purchases up to USD200

- Up to 25X UNI$ for every S$5 spend (10 miles per S$1) on your preferred rewards category with no minimum spend.

Eligibility and Fees:

- Minimum Age: 21 years

- Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees:

- With effect from 1 January 2024:

- Principal card: S$196.20

- First year card fee wavier (Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady’s Card)

- Supplementary Card: Free for first card

- S$98.10 for subsequent card

6. UOB Lady’s Solitaire Card

Features & Benefits:

- 10X UNI$ per S$5 spent (4 miles per S$1) with no min. spend

- Up to additional 15X UNI$ per S$5 spent (6 miles per S$1) when you save with UOB Lady’s Savings Account

- UNI$1 per S$5 spent (0.4 miles per S$1) on other purchases

- 0% Lady’s LuxePay – 6 or 12-month installment plan with no interest or processing fees

- e-Commerce Protection on online purchases

- Complimentary Travel Insurance coverage of up to USD100,000

- Up to 25X UNI$ for every S$5 spend (10 miles per S$1) on 2 of your preferred rewards categories with no min. spend.

Eligibility and Fees:

- Minimum Age: 21 years

- Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees:

- With effect from 1 January 2024:

- Principal card: S$196.20

- First year card fee wavier (Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady’s Card)

- Supplementary Card: Free for first card

- S$98.10 for subsequent card

7. KrisFlyer UOB Credit Card

Features & Benefits:

- Every S$1 spend will earn you:

- 3 KrisFlyer miles on Singapore Airlines, Scoot, KrisShop and Kris+ purchases

- Up to 3 KrisFlyer miles on dining, food delivery, online shopping and travel, and transport spend

- 1.2 KrisFlyer miles on all other spend

- Exclusive privileges on KrisShop, Scoot (via www.flyscoot.com/KrisFlyerUOB), Grab rides and more!

Eligibility and Fees:

- Minimum Age: 21 years

- Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners: Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees:

- With effect from 1 January 2024:

- Principal card: S$196.20

- First year card fee wavier (Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady’s Card)

- Supplementary Card: Free for first card

- S$98.10 for subsequent card

8. UOB PRVI Miles World Mastercard

Features & Benefits:

- Every S$1 spend will earn you:

- 1.4 miles on local spend

- 2.4 miles on overseas spend, including online shopping on overseas websites

- 6 miles (UNI$15 per S$5 spend) on major airlines and hotels through Expedia and Agoda via UOB PRVI Miles website

- Choice to redeem for miles, cash rebate or vouchers

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- For foreigners:

- Minimum annual income S$40,000

OR - Fixed deposit collateral of minimum S$10,000

- Minimum annual income S$40,000

- Fees:

- Principal card:

- S$261.60 yearly

- First year card fee waiver

- Supplementary card:

- First card free

- S$130.80 yearly subsequent card

(With effect from 1 January 2023, annual fee is applicable for new and existing 2nd Supplementary Cards.)

9. UOB PRVI Miles American Express Card

Features & Benefits:

- Every S$1 spend will earn you:

- 1.4 miles on local spend

- 2.4 miles on overseas spend, including online shopping on overseas websites

- 6 miles (UNI$15 per S$5 spend) on major airlines and hotels through Expedia and Agoda via UOB PRVI Miles website

- 20,000 loyalty miles every year with minimum spend of S$50,000 a year

- Enjoy up to 2 complimentary airport transfers quarterly

- Choice to redeem for miles, cash rebate or vouchers

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- For foreigners:

- Minimum annual income S$40,000

OR - Fixed deposit collateral of minimum S$10,000

- Minimum annual income S$40,000

- Fees:

- Principal card:

- S$261.60 yearly

- First year card fee waiver

- Supplementary card:

- First card free

- S$130.80 yearly subsequent card

(With effect from 1 January 2023, annual fee is applicable for new and existing 2nd Supplementary Cards.)

10. UOB PRVI Miles Visa Card

Features & Benefits:

- Every S$1 spend will earn you:

- 1.4 miles on local spend

- 2.4 miles on overseas spend, including online shopping on overseas websites

- 6 miles (UNI$15 per S$5 spend) on major airlines and hotels through Expedia and Agoda via UOB PRVI Miles website

- Choice to redeem for miles, cash rebate or vouchers

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- For foreigners:

- Minimum annual income S$40,000

OR - Fixed deposit collateral of minimum S$10,000

- Minimum annual income S$40,000

- Fees:

- Principal card:

- S$261.60 yearly

- First year card fee waiver

- Supplementary card:

- First card free

- S$130.80 yearly subsequent card

(With effect from 1 January 2023, annual fee is applicable for new and existing 2nd Supplementary Cards.)

11. UOB Visa Infinite Metal Card

Features & Benefits:

- Unlimited airport lounge access for you and a guest

- Earn 2.4 air miles per S$1 spent in foreign currency and 1.4 air miles per S$1 spent locally

- Bonus 15,000 air miles upon renewal with min. S$100,000 spend in membership year

- Waiver of miles conversion fees

- Complimentary welcome drinks and up to 50% off at fine dining restaurants

- Complimentary GrabGifts vouchers monthly

- 24/7 UOB Visa Infinite Concierge

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens, permanent residents and foreigners:

- Minimum annual income S$120,000

- Fees:

- Principal card

- Membership Fee: S$654 yearly (inclusive of 9% GST)

- Please note that this annual card membership fee cannot be waived. Card application is subject to Bank’s approval.

- Supplementary card

- First Supplementary Card: Free for life

- Second and subsequent card(s): S$293.38 yearly (inclusive of 9% GST)

12. Metro-UOB Card

Features & Benefits:

- 10% off regular priced items at Metro

- 5% Metro$ Rebates on your purchases at Metro

- 20% off on your birthday month

- Only available for online applications. Not eligible for Secured Card Applications.

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- For foreigners:

- Minimum annual income S$40,000

- Minimum annual income S$40,000

- Fees:

- Principal card:

- S$196.20 yearly

- First year card fee waiver

- Supplementary card:

- First card free

- S$98.10 yearly subsequent card fee

13. UOB Preferred Platinum Visa Card

Features & Benefits:

- Up to UNI$10 per S$5 spend via mobile contactless

- Up to UNI$10 per S$5 spend on online shopping and entertainment

- Only available for online applications. Not eligible for Secured Card Applications

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- For foreigners:

- Minimum annual income S$40,000

- Fees:

- Principal card:

- S$196.20 yearly

- First year card fee waiver

- Supplementary card:

- First card free

- First year free

- After which an annual fee of S$98.10 will be charged

14. Singtel-UOB Card

Features & Benefits:

- Up to S$360 cashback on consolidated Singtel bills & monthly GOMO charges

- Receive up to S$300 Singtel vouchers every year

- Perpetual annual fee waiver with recurring Singtel bill

- Other Singtel privileges apply.

Eligibility and Fees:

- Applicant must be an individual (non business) Singtel Customer

- Age: 21 years and above

- Singaporean/PR:

- Instant Card approval via Myinfo

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000

- For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000

- Fees:

- Principal card:

- S$196.20 yearly

- First year card fee waiver

- Supplementary card:

- First card free

- S$98.10 yearly subsequent card

15. UOB UnionPay card

Features & Benefits:

- 2% cashback on all spend with no minimum spend

- Acceptance worldwide at over 41 million merchants

- Up to 10% off at over 100 International Airport Duty Free Shops

- Up to 21.6% fuel savings at SPC

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- Fixed Deposit collateral of minimum S$10,000#

- For foreigners:

- Minimum annual income S$40,000

OR - Fixed deposit collateral of minimum S$10,000

- Minimum annual income S$40,000

- Fees:

- Principal card

- S$196.20 yearly

- First three years card fee waiver

- Supplementary card

- FREE first card

- S$98.10 subsequent card

16. UOB Visa Signature Card

Features & Benefits:

- Earn 10X UNI$ on overseas , online, petrol and contactless transactions, and 1X UNI$ on all other spend with no cap.

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$50,000

- For foreigners:

- Minimum annual income S$40,000

- Fees:

- Principal card

- S$218 yearly

- First year card fee waiver

- Supplementary card

- FREE first card

- S$109 yearly subsequent card

17. UOB Professionals Platinum Card

Features & Benefits:

- Open to members of:

- Medical Alumni Association

- Institute of Singapore Chartered Accountants (ISCA)

- Law Society of Singapore

- Singapore Medical Association (SMA)

- The Association of Chartered Certified Accountants (ACCA)

- The Institution of Engineers, Singapore (IES)

- Dining privileges

- UOB$ Cashback

Eligibility and Fees:

- Minimum age 21 years old

- For Singapore citizens and permanent residents:

- Minimum annual income S$30,000

- Fixed Deposit collateral of minimum S$10,000

- For foreigners:

- Minimum annual income S$40,000

OR - Fixed deposit collateral of minimum S$10,000

- Minimum annual income S$40,000

- Fees:

- Principal card

- Free for Life

- Supplementary card

- FREE first card

- S$98.10 (inclusive of 9% GST) for 2nd and subsequent cards

Documents required to apply for UOB credit cards available in Singapore:

- Singapore citizens and permanent residents:

- NRIC (front and back)

- Income Documents (Refer to List of Income Documents below)

- Latest billing proof dated within the last 6 months with your full local residential address if it differs from your NRIC address (Refer to List of billing proof documents below)

- Foreigners:

- Valid Passport(s) (with at least 6 months’ validity and for all nationalities)

- Employment Pass (EP or S Pass only with at least 6 months’ validity)

- Latest billing proof dated within the last 6 months with your full local residential address if it differs from your NRIC address (Refer to List of billing proof documents below)

- Income Documents (Refer to List of Income Documents below)

Income documents required to obtain UOB credit cards in Singapore:

- Latest 12 months’ CPF Contribution History Statement

- Latest Computerised Payslip (in Singapore Dollar currency)

- Latest 3 months’ Computerised Payslip (in Singapore Dollar currency)

- Latest Income Tax Notice of Assessment and A or B

- Latest Income Tax Notice of Assessment

- Company Letter certifying Employment and Monthly Salary (in Singapore Dollar currency) dated within 3 months

- Latest 3 months of consecutive full weekly statements from company

The application process for UOB credit cards in Singapore is an easy one. Simply visit the bank website, browse through the credit cards available and select any of your choice. Click on “apply” and follow the instructions. Ensure that all necessary documents are available before starting the application process.

You may also like...

Copyright © 2016 Hot Topix Theme. Theme by MVP Themes, powered by Wordpress.

0 comments